washington state long term care tax opt out requirements

The Long-Term Care Act was. You can design your policy to have substantial daily benefits 400-500Da for years or even unlimited versus the 100day for 1 year for maximum of 36500 that is provided by the.

Multiple States Considering Implementing Long Term Care Tax Ltc News

First to opt out you need private qualifying long term care coverage in force before November 1 2021.

. You can then apply for an exemption from the state between Oct. Lets assume for the moment that you dont opt-out of the Washington long-term care tax program before the December 31 2022 deadline. Time has run out.

If you have this type of policy you can opt-out if the following requirements are met by October 1st. The tax will total 058 percent of your W-2 income with no maximum limit. This law concerning long-term care should be repealed by lawmakers.

You will not need to submit proof of coverage when applying for your. No matter your age or health status the WA Cares Fund provides affordable long-term care coverage. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program.

In that case the tax will be. Read more about the regressive tax and misguided law that created it here. Basics of the WA Cares Tax.

The new mandate burdens. You must attest that they had private long term care coverage before. Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares.

It is too late. You needed to apply earlier to have coverage in place by. Applying for an exemption.

Long-term care LTC insurance according to Washington state law legwagov is an insurance policy contract or rider that provides coverage for at least 12 consecutive months to. Under current law you have one opportunity to opt out of this tax by having a long-term care insurance LTCi policy in place by November 1 st 2021. For example employees who earn a 125000 annual salary will pay.

WHAT IS THE TAX. 1 of this year and Dec. Washington State recently passed a new law called the Washington Long Term Care Trust Act which requires employees to contribute a new payroll tax that will tax peoples wages to.

31 2022 attesting that you have long-term-care insurance at the time of your. Apr 26 2021 Washington State has passed a new law mandating public long-term care LTC benefits for Washington residents. It is too late to Buy LTC insurance to avoid the Washington Long Term Care Tax.

Private insurers may deny coverage based on age or health status.

What You Need To Know About Washington State S Public Long Term Care Insurance Program

Kuow Want To Opt Out Of Washington S New Long Term Care Tax Good Luck Getting A Private Policy In Time

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times

Ltca Long Term Care Trust Act Worth The Cost

Washington State S Celebrated Long Term Care Program Is Headed Towards Trouble

What To Know Washington State S Long Term Care Insurance

What To Know Washington State S Long Term Care Insurance

2022 Long Term Care Insurance Information Washington Education Association

Long Term Care Financing Reform Proposals That Involve Public Programs American Academy Of Actuaries

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Wa Legislature Oks Pause To Long Term Care Program And Tax

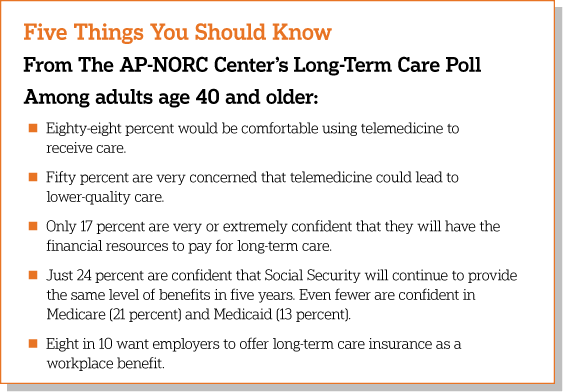

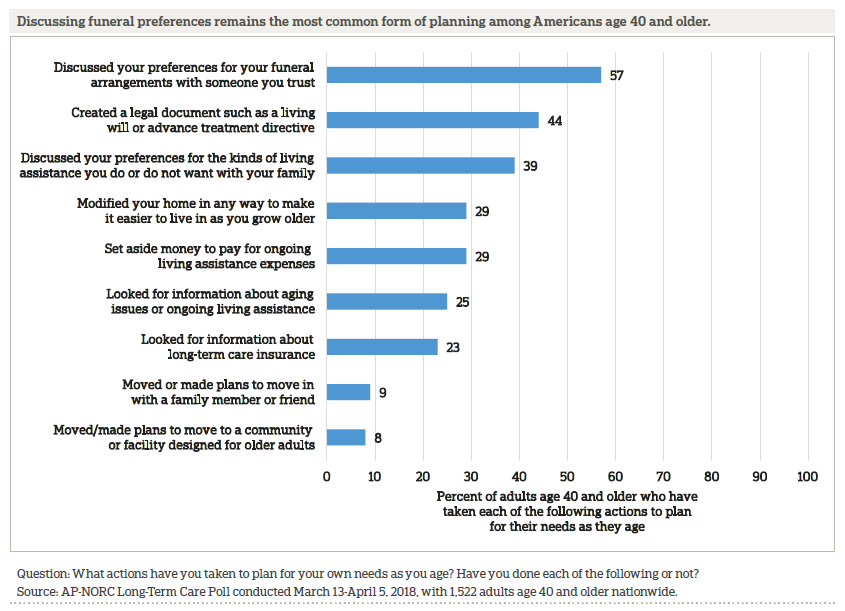

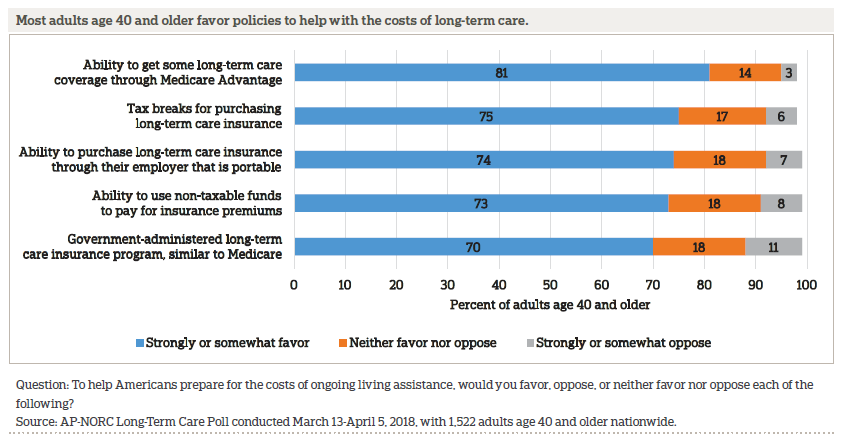

Long Term Care In America Increasing Access To Care The Long Term Care Poll

Long Term Care In America Increasing Access To Care The Long Term Care Poll

Long Term Care In America Increasing Access To Care The Long Term Care Poll

Wa Cares Exemption How To Opt Out Of The Tax Brighton Jones

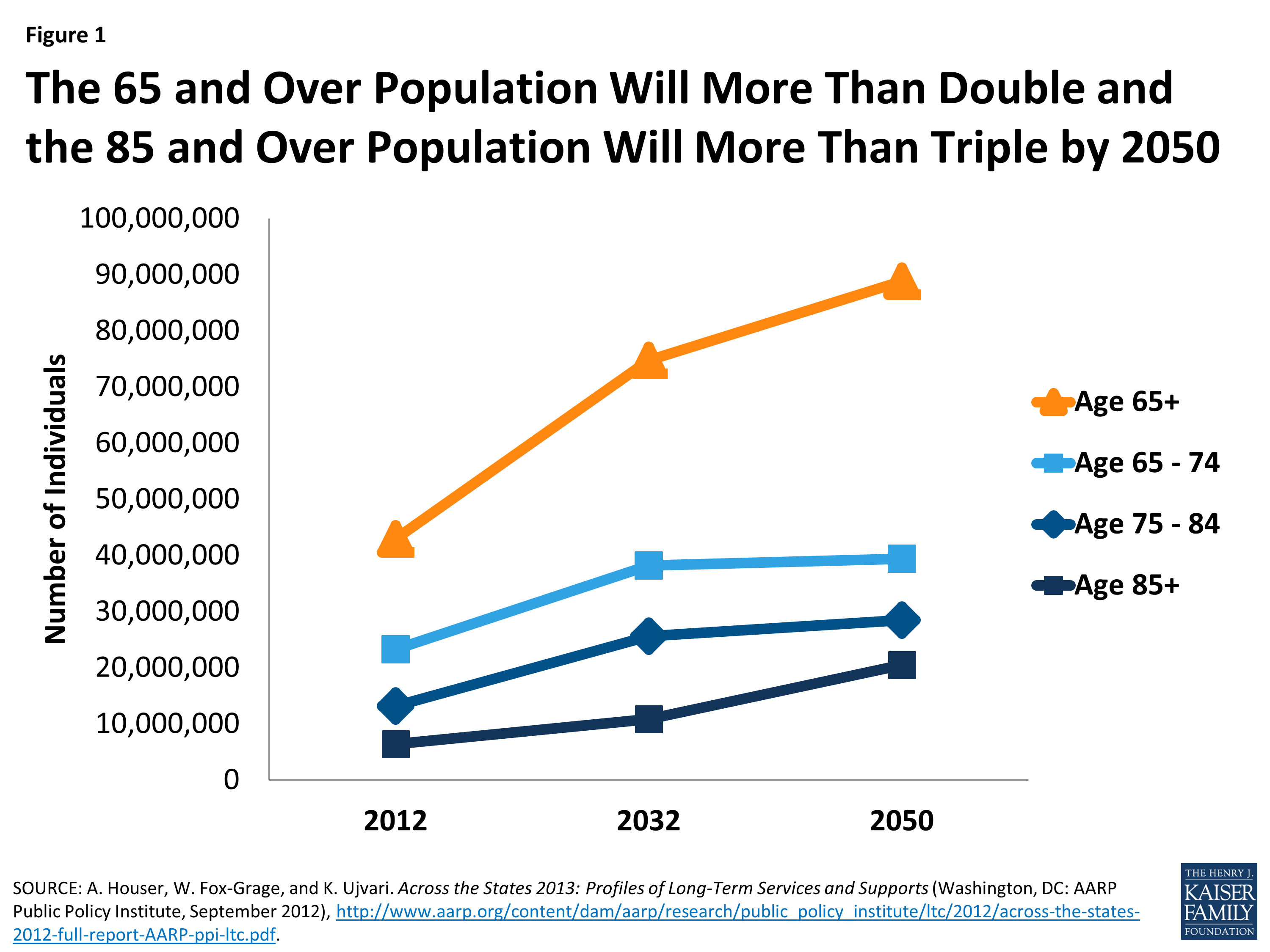

Medicaid And Long Term Services And Supports A Primer Kff

Updated Get Ready For Washington State S New Long Term Care Program Sequoia

Washington S Public Long Term Care Program Is Good Actually And You Should Opt In The Stranger

Washington Lawmakers Look At Long Term Care Program As Frustration Builds Over Benefits And Payroll Tax The Seattle Times